How to Buy Producer Royalties

Checklist to streamline your next producer overrides acquisition.

Hello, and welcome to this week’s edition of this newsletter:

How to Buy Producer Royalties

If you are a catalog buyer looking to purchase producer royalties, this guide will help you go from zero to hero while avoiding costly mistakes.

In this issue, you will learn the fundamentals in plain language:

How producer royalties work,

Why buy producer royalties,

What every music catalog needs to understand when purchasing producer royalties.

The Problem

There is little to no information on how music catalog acquisitions actually work. When I started, I had to borrow from the M&A playbook and figure out what really applies to the music industry.

How Producer Royalties?

Producer royalties are money generated by the exploitation of the sound recording. Producer royalties are also knowns as producer points or producer overrides.

Often, producer royalties are calculated based on the artist’s share.

Example: A sound recording generates $10,000 in royalties.

Label / Artist Split: 80/20

Producer gets 1% "all-in"

Breakdown:

Label: $8,000

Artist: $2,000

Producer: $20

There are three common scenarios.

Three typical cases:

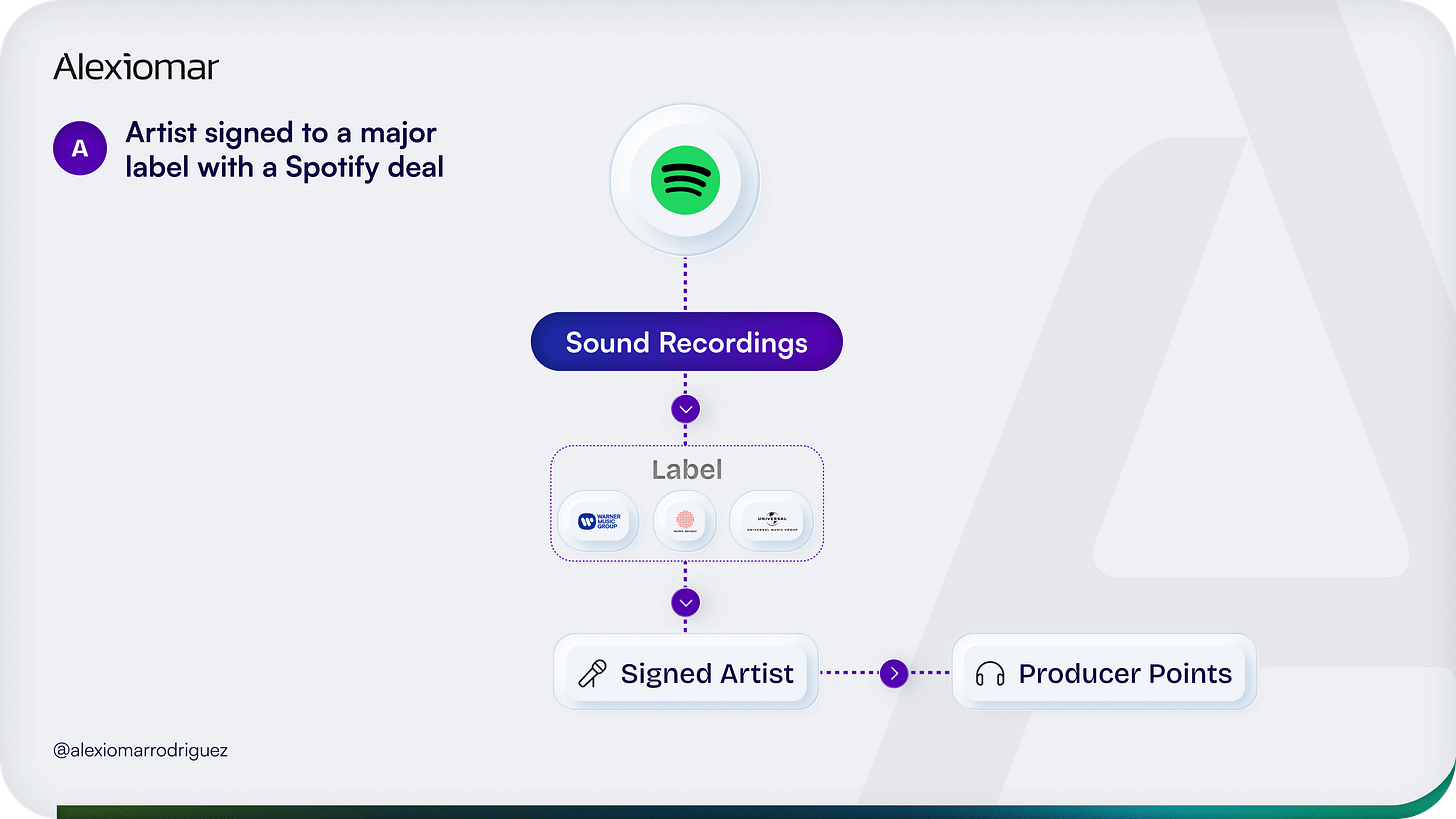

A – Artist signed to a major label

Platforms pays the label

Label pays the artist

B – Self-released artist

Platforms pays distributor

Distributor pays artist

C – Artist signed to an independent label

Platforms pays the label's distributor

Distributor pays the label

Label pays the artist

In all three scenarios, producer points (overrides) usually come from the artist's share.

Why buy Producer Royalties?

Passive Income: Royalties are low-touch. Labels handle payments.

No Marketing: You buy income, not copyright. No need to pitch or promote.

Piggyback on Success: Major labels or superstar artists drive value.

Consistent Cash Flow: Reliable revenue without active management.

How to Buy Producer Royalties?

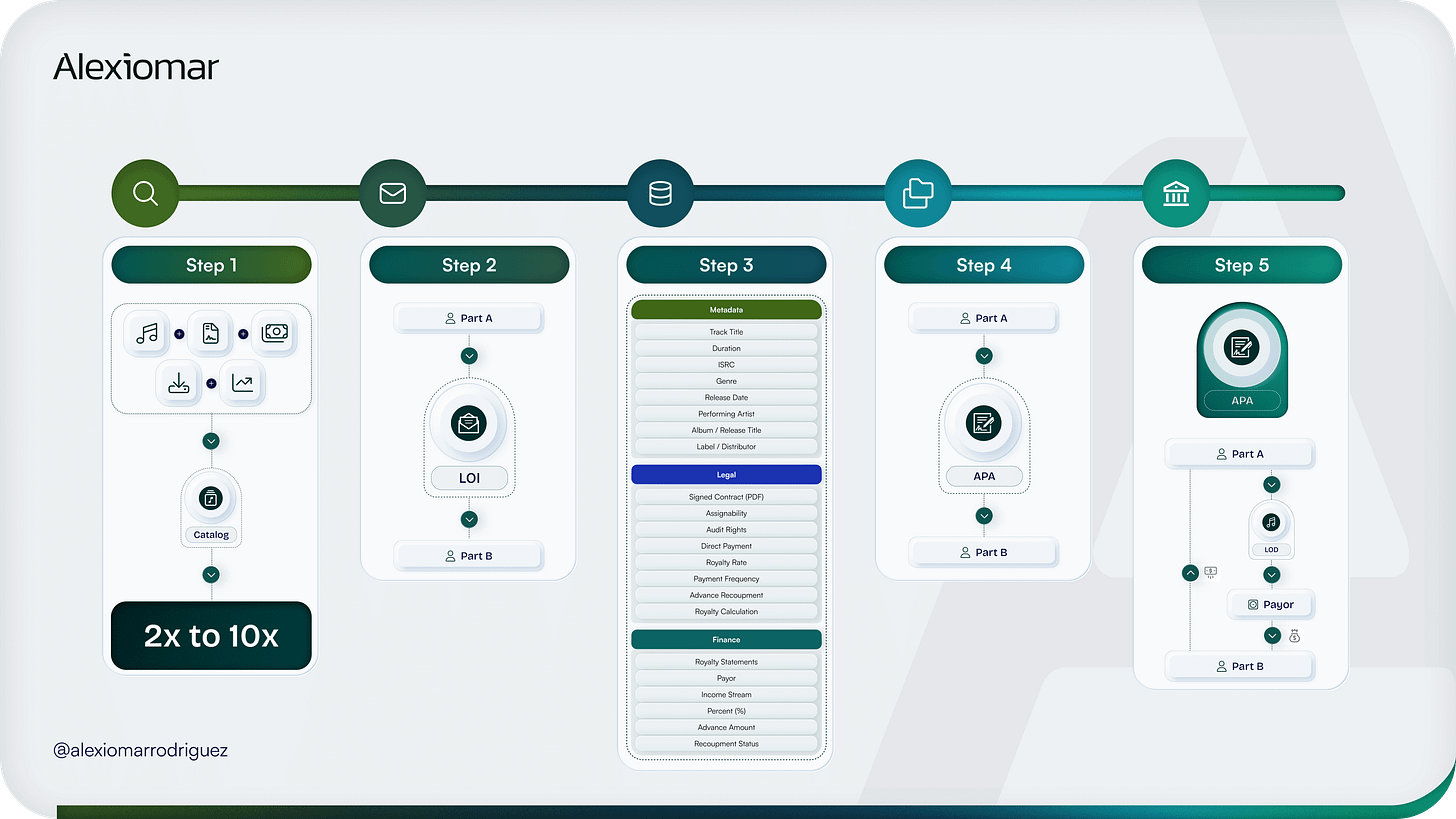

Step 1 – Identify a Potential Seller

Key factors that affect valuation, according to music fund advisor Alex Gramatzki:

Age of catalog

Last 3 years earnings

Contractual rights

Monthly Spotify listeners

Genre

Type of rights

Upcoming Events or releases

Song popularity (streams)

Valuation multiples range from 2x to 10x or more.

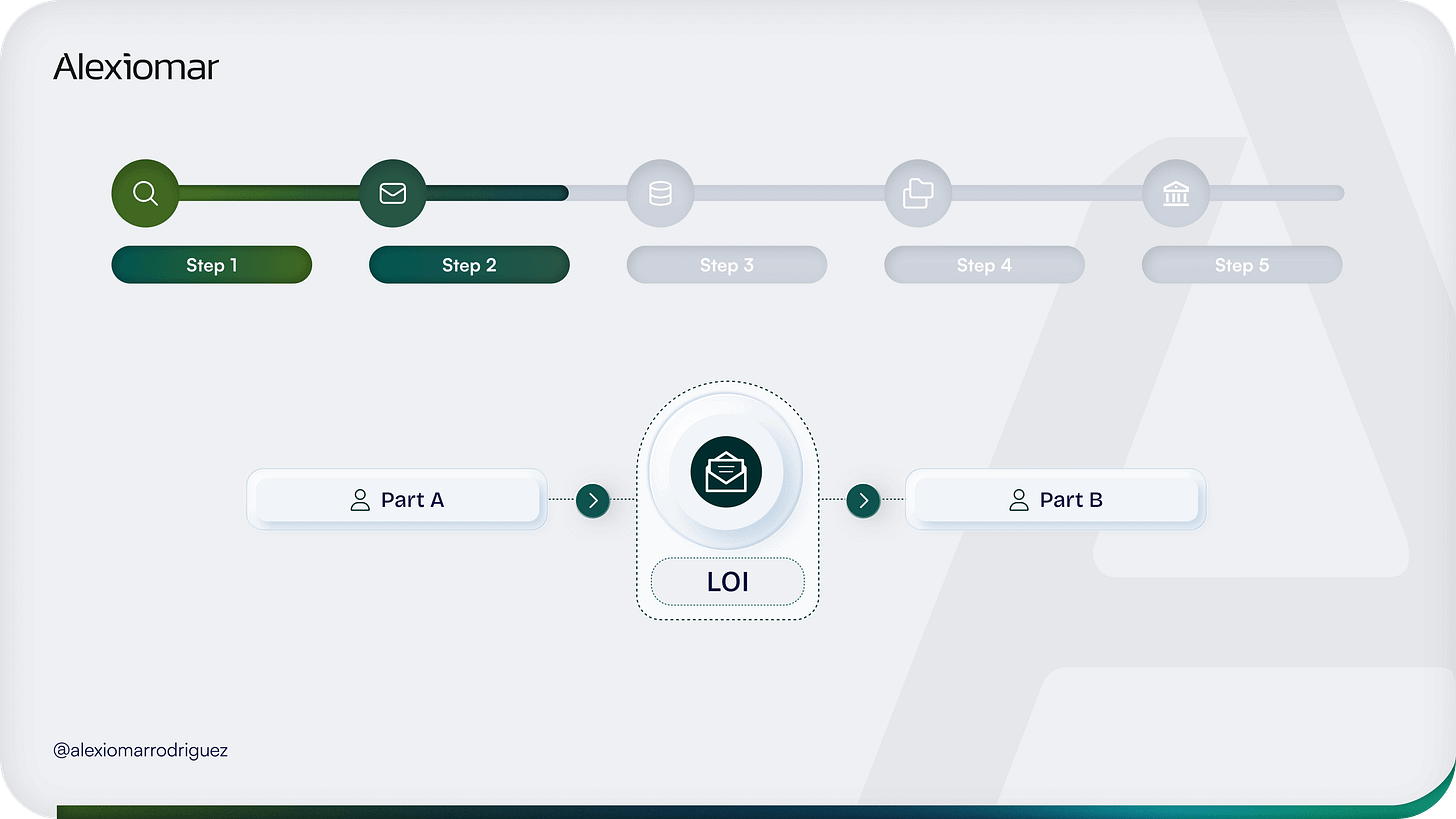

Step 2 – Send a Letter of Intent (LOI)

Summary of proposed terms:

Assets

Purchase Price

Holdback

Closing Date

Net Price

Representations and Warranties

Confidentiality

Exclusivity

Conditions to Close

Additional Diligence

Royalty Handling Post-Close

Expiration

Governing Law

Costs and Expenses

Step 3 – Due Diligence

Metadata

Track Title

Duration

ISRC

Genre

Release Date

Performing Artist

Album / Release Title

Label / Distributor

Legal

Contract type (Producer Agreement)

Key clauses:

Assignability

Audit Rights

Direct Payment

Royalty Rate

Payment Frequency

Advance Recoupment

Royalty Calculation

Finance:

Royalty Statements

Payor

Income Stream

Percent (%)

Advance amount

Recoupment status

SoundExchange LODs and Assignability

Some producers receive royalties from SoundExchange as featured artists, typically via a Letter of Direction (LOD). These featured artist royalties are payable to individuals who directly contributed to the recordings—such as producers, mixers, or engineers.

While the statute doesn’t explicitly prohibit these individuals from assigning their royalty rights to third parties, including institutional buyers, SoundExchange imposes an operational limitation: it will only honor LODs directing payment to recipients who are themselves creative participants. In other words, SoundExchange will not redirect payment to catalog buyers, funds, or other non-creative entities—even if there is a valid contractual assignment.

As a result, any assigned SoundExchange income must flow through the individual payee (the producer) and then be remitted contractually to the buyer. Some music investors are comfortable acquiring these rights with that structure in place, but they typically require strong representations, covenants, and post-closing compliance mechanisms to manage the administrative and enforcement risks. Others choose to exclude this income from their valuation models altogether for simplicity and certainty.

Step 4 – Asset Purchase Agreement

The Asset Purchase Agreement is the legal document detailing the purchase of override rights.

Here are the typical clauses I include:

Purchase and Sale of Override Rights

Transfer of Rights

Exclusivity and Perpetuity

Price and Payment Method

Closing Obligations

Grant of Rights

Seller Covenants

Representations and Warranties

Post-Closing Obligations

Power of Attorney

Miscellaneous (Law, Taxes, Signatures, etc.)

Schedules:

A: List of Tracks & ISRCs

B: Letter of Directions (Payor)

C: Seller Payment Instructions

Step 5 – Closing + Post Closing

Execute the APA

Make initial wire transfer

Send LOD to the payor

Purchaser begins receiving payments

Conclusion

Buying producer royalties is a smart way to generate low-maintenance income. With the right checklist and due diligence, you can avoid mistakes and close profitable deals.

Want help with catalog acquisition?

Reach out at alexiomar@xiola.co

🔥🔥🔥